CIRP - Silicon Valley Bank Collapse

Another attempt to try to include re-posted financial-advice marketing commentary from Contrarian Outlook to a personal Raspberry Pi server for archival and reading.

What the Silicon Valley Bank Collapse Means …

Michael Foster, Investment Strategist

Updated: March 16, 2023

The Silicon Valley Bank (SIVB) mess has demonstrated exactly why we need to invest in closed-end funds (CEFs): these funds yield 8.1% on average, giving us an income stream that can get us through market volatility, like we’re seeing now.

In fact, the SIVB failure shows one of the often-underappreciated aspects of CEFs: when you hold a diversified portfolio of these funds, you’re getting exposure to thousands of stocks, bonds, REITs and many other asset classes.

So even if you have an SIVB hidden in there somewhere, it will have little—and likely no—impact on your overall returns. (And subscribers to my CEF Insider service don’t need to worry—none of our funds have exposure to SIVB, and none have exposure to regional banks suffering from the contagion.)

Meantime, you get a steady, high and often monthly dividend rolling in to keep your bills paid. But even so, you no doubt have questions about what this failure might mean going forward, so let’s delve into the nuts and bolts of what happened.

What the SIVB Collapse Means for Stocks—and High-Yield CEFs

From a high level, banks operate on a basic premise: you take in depositors’ money, use that money to buy U.S. Treasuries, pay out less than the interest you get on those Treasuries to depositors—and keep the rest.

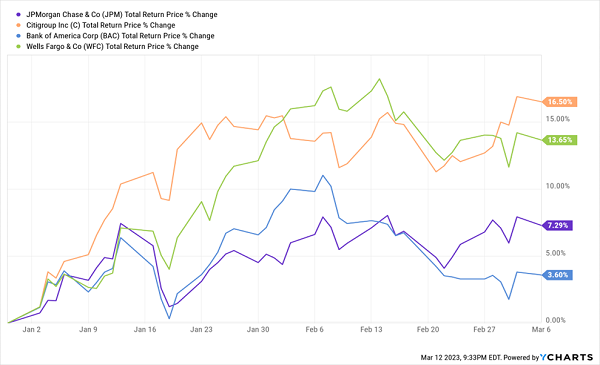

Higher net interest income has in fact, powered profits at major US banks: in its latest quarter, JPMorgan Chase & Co. (JPM) saw net interest income rise 48% over the prior year, to $20.3 billion. It was a similar story at Bank of America (BAC), where net interest income rose 29%. Other big banks put up similar numbers, with a 61% increase at Citigroup (C) and 45% at Wells Fargo (WFC). As a result, these banks were off to a strong start this year … until the SIVB news broke.

Happy Banks Prior to the SIVB Collapse

Full details on what exactly happened behind the scenes at Silicon Valley Bank are still trickling out, but we do know that Peter Thiel’s Founder’s Fund thought it was risky and warned start-ups, SIVB’s primary client base, to begin pulling their money.

Since SIVB specializes in funding for tech start-ups (hence the name), and since Thiel is well-known in this world (especially on financial issues), these companies did just that. That left SIVB’s portfolio of bonds too long-dated to handle the demand for deposits. As a result, it went below regulatory limits for the amount of assets it had on its balance sheet.

The market, naturally, panicked. SIVB was, rightly, heavily sold (while depositors at SIVB will be made whole, including those with account balances beyond the insured limit). But big banks like JPMorgan, Citibank, Bank of America and Wells Fargo—and even the broader tech sector—were sold off, too.

This is an overreaction. Sure, SIVB ran out of money because of its focus on a sector going through some justified worry after years of high spending. But it’s important to bear in mind that depositors won’t be affected by this.

However, it does highlight a problem caused by the Fed’s swift interest-rate hikes. As we all know, the central bank has raised rates from 0.25% to 4.75% in a year. Not only is this 1,800% hike the fastest rate hike we’ve seen in several generations, it’s also the highest rates have been in nearly 20 years.

If you’re a business owner looking to borrow, that’s an annoyance. Now you have to be really confident a venture will generate a high rate of return before trying to borrow money.

But banks are in the business of borrowing at many levels. Banks that took in a lot of deposits in 2021 and not as many in 2022 could find themselves in trouble if all of their depositors demand their money at once. That’s a possibility for a bank focusing on one sector like SIVB. But it’s pretty much impossible for big banks like Citi, Wells, JPMorgan and Bank of America. The phrase “too big to fail” exists for many reasons, and this is one of them.

It does mean, however, that smaller banks could be at risk, particularly regional banks or banks focusing on one risky industry. (We’ve already seen this at Signature Bank [SBNY], which mostly deals with crypto firms.) Again, this likely won’t affect depositors; in these cases, they’re all likely to be made whole as the assets transfer to different banks.

And if you own stocks, bonds or funds? You don’t need to worry. ETFs, CEFs and mutual funds don’t rely on bank borrowing, so there’s no bank-related concern around their ability to pay dividends. In fact, the selloff has resulted in deeper CEF discounts—and some nice buying opportunities in our CEF Insider portfolio.

This Instantly Gets You an “All-Weather” 9.5% Dividend (Paid Monthly!)

As I mentioned above, a mess like the one we’re seeing at SIVB demonstrates the power of safe—and monthly!—CEF dividends.

That, plus a high 9.5% current yield, is exactly what you get in the 4-CEF “mini-portfolio” I’ve constructed. With just shy of 10% of your investment boomeranging back to you in the form of a monthly dividend every year, you can relax and collect your checks—and tune out the market noise!

I’d love to show you these 4 funds right here, right now. But they’re all recommendations of my CEF Insider service, and that wouldn’t be fair to my paying members. So I’m going to do the next best thing:

Don’t miss your chance to buy these four 9.5%-paying CEFs while the SIVB crisis has made them ridiculously cheap.